Picture this: currency trading is a wild roller coaster and Forex signals are your trusty safety harness—keeping you strapped in while you scream in both joy and horror at market fluctuations!

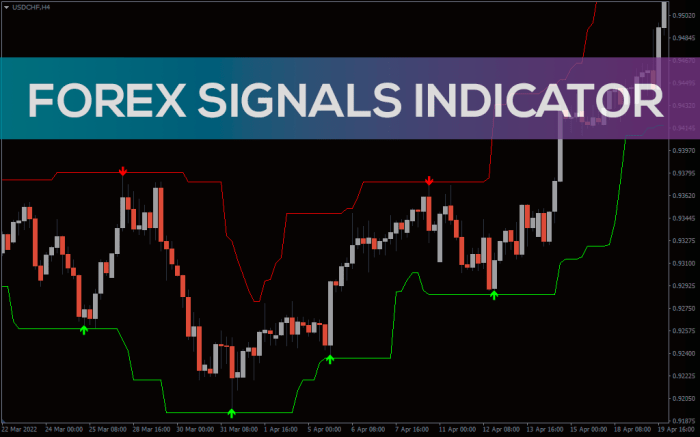

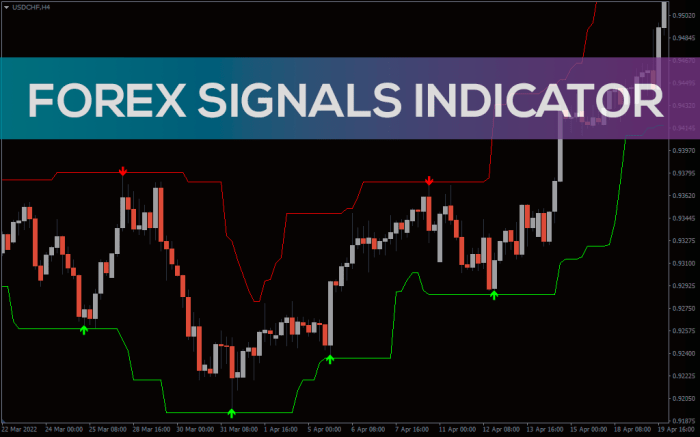

Forex signals are essentially alerts that guide traders on when to buy or sell currency pairs, a bit like whispering sweet nothings of financial wisdom in your ear. They come in various flavors: from manual signals crafted by seasoned experts to automated ones generated by the latest tech wizardry. Why is this significant, you ask? Well, in the fast-paced world of Forex, having the right signals at the right time can mean the difference between a financial high-five and a face-palm moment!

Forex Signals

Forex signals are like your trading GPS, guiding you through the often turbulent and chaotic seas of currency trading. These signals help traders make informed decisions about when to buy or sell specific currency pairs, ultimately aiming to maximize profits while minimizing losses. In a market that operates 24/5, having a reliable signal can be the difference between waking up to a cheerful bank balance or a sad face staring back at you from your trading platform.One of the key aspects of Forex signals is their diversity.

There are various types available, catering to different trading styles and preferences. Some signals are based on technical analysis, where traders utilize charts and indicators to forecast future price movements. Others may be fundamentally driven, relying on economic news and events that directly impact currency values. These signals can be delivered in several formats, including email alerts, SMS notifications, or even through dedicated trading platforms.

Now, let’s explore some specific types of Forex signals available in the market.

Types of Forex Signals

Understanding the different types of Forex signals can illuminate your trading journey and help you select the right tools for your trading arsenal. Below are a few commonly used types:

- Technical Signals: These signals utilize chart patterns, indicators, and historical price data to predict future movements. For example, a trader may notice a bullish flag pattern indicating a potential price increase.

- Fundamental Signals: These are based on economic data releases, geopolitical news, and other fundamental factors. An unexpected employment report can trigger a significant movement in currency pairs.

- Sentiment Signals: These signals gauge market sentiment based on trader positions and behavior. If a majority are shorting a currency pair, it may indicate an impending reversal.

- Algorithmic Signals: Created through algorithms and automated systems, these signals analyze vast amounts of market data in real-time to generate trade alerts. They often execute trades without human intervention.

The role of technology in Forex signals cannot be overstated. It’s akin to having a super-smart assistant who never sleeps and is always on the lookout for trading opportunities. Technological advancements have enabled traders to access sophisticated tools and platforms where signals are generated and disseminated almost instantaneously. For instance, machine learning algorithms can analyze millions of data points in seconds, providing traders with insights they might miss if relying on manual analysis.

“Technology is the new trading buddy; it never takes a coffee break or needs a bathroom run!”

In addition, mobile apps and trading platforms have made it easier for traders to receive real-time alerts while on the go. Imagine sipping your morning coffee, and suddenly your phone buzzes with a signal alerting you to a lucrative trading opportunity – that’s the power of technology in action! Thus, Forex signals backed by cutting-edge technology not only enhance trading accuracy but also empower traders to make quick decisions in the fast-paced world of foreign exchange.

Finance and Credit Management

When it comes to managing finances and credit, it might feel like trying to tame a wild bull with a toothpick. However, with the right strategies and a sprinkle of humor, you can master the rodeo of your fiscal responsibilities. Let’s saddle up and explore how effective credit counseling, debt consolidation, and some handy credit tips can steer you toward a healthier financial future.

Effective Credit Counseling Strategies

Credit counseling is like a financial GPS, guiding you through the labyrinth of debt and credit scores. Here are some strategies to improve your personal finance through credit counseling:

- Budgeting Basics: Start with a detailed budget that tracks income and expenses. It’s like a diet for your wallet; only instead of cutting calories, you’re slicing unnecessary expenses.

- Debt Management Plans: A credit counselor can help you create a plan to manage your debts effectively. Think of it as a workout regimen, but instead of lifting weights, you’re lifting your financial burdens.

- Education and Resources: Utilize the educational materials provided by your counselor. They’re like the “For Dummies” series but for your finances—everyone can benefit from a little guidance.

Debt Consolidation Methods and Advantages

Debt consolidation is akin to putting all your eggs in one basket—not a risky move if you know how to handle that basket! Below are some popular methods of debt consolidation along with their advantages for your financial health:

- Personal Loans: Taking out a personal loan to pay off multiple debts can simplify payments into one monthly sum, potentially with a lower interest rate. Less chaos equals less stress!

- Balance Transfer Credit Cards: These cards allow you to transfer high-interest debt to a card with a lower or zero interest rate for a promotional period. It’s like getting a free pass on your financial rollercoaster.

- Home Equity Loans: Using your home’s equity can be a great way to consolidate debt. Just remember, you’re putting your home on the line, so tread carefully!

Credit Tips for Improving Credit Scores

Improving your credit score is like trying to get a perfect score in a video game; it takes strategy, patience, and a little bit of skill. Here are some tips to help consumers improve their credit scores:

- Pay Bills on Time: Your payment history makes up a large part of your credit score. Set up reminders or automatic payments—it’s better than forgetting your anniversary!

- Keep Credit Utilization Low: Aim to use less than 30% of your total credit limit. Think of it as keeping your credit card’s diet in check; don’t let it feast on all your available credit.

- Regularly Check Your Credit Report: Look for errors that could be dragging down your score. It’s like spring cleaning for your finances—out with the old and inaccurate!

- Avoid Opening Too Many New Accounts at Once: Each application can temporarily ding your score. Think of it like trying to join every club at school; sometimes it’s best to focus on a few.

“A good credit score is like a good reputation; it opens doors you didn’t even know existed.”

Currency Trading and Debt Management

In the fast-paced world of currency trading, managing debt might feel like juggling flaming swords while riding a unicycle. However, with the right strategies, it’s possible to turn that tightrope walk into a tango. Understanding how currency trading and debt management intertwine can lead to more effective financial strategies and potentially a more comfortable lifestyle.The relationship between currency trading and debt management hinges on the dynamics of foreign exchange rates and their impact on debt obligations.

Currency fluctuations can affect the value of debt denominated in foreign currencies, altering repayment amounts and financial stability. For instance, if an individual has a debt in Euros but earns income in US Dollars, a strengthening Dollar could ease the burden of repayment, while a weakening Dollar could inflate the cost of servicing that debt. Thus, mastering currency trading can not only provide opportunities for profit but also offer tools for optimizing debt management strategies.

Utilizing Forex Signals for Debt Relief Options

Utilizing Forex signals can significantly enhance debt relief options by providing real-time insights into currency movements. This proactive approach helps traders and debt holders make informed decisions, reducing risks associated with currency fluctuations. Here’s how you can leverage Forex signals effectively:To start, it’s essential to grasp the benefits of Forex signals in the context of debt relief:

- Timely Information: Forex signals provide up-to-date analysis on currency trends, helping you make strategic decisions regarding your debt repayments.

- Risk Management: By utilizing signals, you can identify potential market shifts that may affect your debt obligations, allowing you to manage risks more effectively.

- Opportunity Recognition: Successful trading can generate additional income, which can be directed towards paying off debts more rapidly.

By incorporating Forex signals into your debt management strategy, you can position yourself to take advantage of favorable currency movements, allowing you to potentially reduce the cost of debt over time.

Estate Planning Trusts and Their Importance in Financial Asset Management

Estate planning trusts serve as a crucial tool in managing financial assets, especially during times of market volatility. Understanding their role can provide peace of mind and safeguard your investments. Trusts can protect assets from creditors and provide a structured approach for transferring wealth to beneficiaries, ensuring that your financial legacy is preserved.The importance of estate planning trusts can be highlighted through several key aspects:

- Asset Protection: Trusts shield assets from creditors, which is particularly important if currency trading goes awry.

- Tax Efficiency: They can help minimize tax liabilities, allowing your investments to grow more efficiently and supporting debt management.

- Control Over Distribution: Trusts allow you to dictate how and when your assets are distributed, ensuring that your wishes are honored even in fluctuating market conditions.

By integrating estate planning trusts into your financial strategy, you enhance your capacity to weather market storms and manage debts more effectively, ensuring that your hard-earned assets remain intact for future generations.

Closing Summary

In conclusion, mastering Forex signals is like learning to dance—once you get the rhythm, you glide effortlessly across the trading floor. So whether you’re a seasoned trader or just stepping into the arena, remember that these signals are your cheat sheet to navigating the currency market’s ups and downs. Embrace them, and who knows? You might just twirl your way to financial success!

Quick FAQs

What are Forex signals?

Forex signals are indicators that suggest when to buy or sell currency pairs based on market analysis.

Are Forex signals reliable?

While they can be helpful, no signal is foolproof. It’s best to use them as part of a broader trading strategy.

Can beginners use Forex signals?

Absolutely! Forex signals can help beginners make informed decisions without having to decode the market alone.

How often are Forex signals generated?

It varies! Some providers offer signals multiple times a day, while others might provide them weekly or monthly.

What technology is used for generating Forex signals?

Many signals are generated using algorithms and trading software that analyze past data and market trends.